003: Diving into Natural Disaster Forecasting

Plus: CFTC outlines prediction market stance, upcoming US government shutdown forecasts & more.

Welcome back to Predictions, the hottest newsletter about quantified forecasting and prediction markets. In this issue:

News in Numbers: Trump Blocked from Ballot, US Government Shutdown, Biden Removed from Office & more

Deep Dive: Natural Disaster Forecasting: Why it matters? Is it possible? And what should be done

Global Guess: Will Saudi-Arabia and Israel Normalize Diplomatic Relations before 2025?

The Base Rate: How the CFTC views enforcement of prediction markets, human vs. machine forecasting & more

❤️ Don’t forget to like the newsletter. It’s like a tip, but free!

🔁 If you loved the newsletter, please consider restacking it!

News in Numbers: 15 September 2023

Trump Ballot Removal: The Constitution's disqualification clause and how it's being used to try to prevent Trump from running for president (CBS News)

Trump’s Next Legal Drama—a Reconstruction-Era Amendment Barring Insurrectionists From Office (WSJ)

Alien Existence: Researcher shows bodies of purported "non-human" beings to Mexican congress at UFO hearing (CBS News)

US Government Shutdown: Congress is in crisis. There’s no clear escape. (POLITICO)

Chevron-Offshore Alliance Strike: Chevron ordered back to mediation over LNG dispute (Australian Financial Review)

Israel “Reasonableness” Law: At historic 13-hour hearing, judges challenge assertion they can’t reject Basic Laws (The Times of Israel)

Biden Removal from Office: Biden impeachment inquiry: What we know about the case (BBC News)

Hunter Biden indicted on gun charges (CNN)

RECORD YOUR PREDICTIONS

Do your own research! Explore diverse perspectives and stay informed with the world's largest news aggregator, Ground News. Sign up using this link to reveal the hidden biases behind every story.

Deep Dive: Natural Disaster Forecasting

In the second issue of Predictions, we reviewed a research paper published by Perry World House at the University of Pennsylvania which explored making aggregated forecasting platforms more useful to policymakers. We attempted to take the paper’s line of inquiry even further, and ventured to slot forecasting into the policymaking process ourselves. But in light of recent events, we now think it’s wise to both take a step back and get more specific as we think about how to leverage forecasting in high-impact areas.

Late last Friday night, Morocco was hit with a 6.8 magnitude earthquake near Marrakech that has taken nearly 3,000 lives and injured over 5,000. A 4.9 magnitude aftershock followed. Emergency responses have been held up due to geopolitical disagreements and alleged domestic political neglect, only worsening the tragedy. Damages beyond the loss of human life do not yet seem to be calculated.

Over the same weekend, Mediterranean Storm Daniel hit Libya, bringing with it heavy rainfall and flooding that resulted in large-scale destruction. Included in that destruction were two critical dams, which after breaking, led to increased flooding resulting in the loss of homes. As of Wednesday, more than 5,000 have been presumed dead with over 6,000 people still missing.

In a single weekend, nearly 20,000 lives were tragically affected by natural disasters around the Mediterranean Sea. And the rate of natural disasters occuring only seems to be increasing as the climate warms. As forecasters, we believe to our core that at least some of this devastation could have been avoided. Foreseen.

There are two areas of natural disasters where forecasting could be exceedingly useful (that we’ve identified).

Can We Predict Natural Disasters?

First, most obviously, you can try to forecast the actual occurrence of a natural disaster. This is what we’ll call event-based forecasting. And within event-based forecasting for natural disasters, there is a range of success and accuracy.

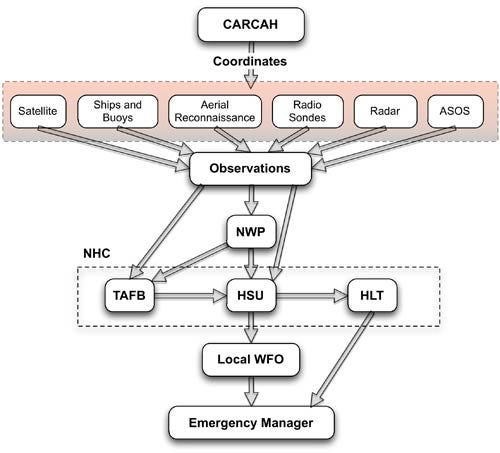

Predicting weather-related natural disasters seems to be a much more far-along endeavor, likely because weather-related natural disasters are within the scope of general meteorological services i.e. the National Weather Service. For example, hurricane forecasts feed a wide breadth of data from satellites, ships, radar feeds etc. into several predictive models to determine “a hurricane’s future track and intensity.”

Those results are then evaluated by human forecasters who “use their experience and judgment to decide how to use the individual and ensemble model guidance to produce the best possible forecast.” And while this system isn’t perfect, we can anecdotally recall successful hurricane evacuation warnings being heeded and saving lives. But these processes aren’t available everywhere: “If there would have been a normal operating meteorological service, [Libya] could have issued the warnings,” World Meteorological Organization head Petteri Taalas told reporters in Geneva. “The emergency management authorities would have been able to carry out the evacuation.”

Forecasting earthquakes, however, is a completely different exercise. In this article published by the United States Geological Survey titled Can you predict earthquakes?, the first word is “No.” The article goes on to say that “Neither the USGS nor any other scientists have ever predicted a major earthquake. We do not know how, and we do not expect to know how any time in the foreseeable future.” The best we can do at this current moment, according to the article, is calculate “the probability that a significant earthquake will occur (shown on our hazard mapping) in a specific area within a certain number of years.” For more on earthquake forecasting check out this article – it won’t make you more optimistic.

Even the CFTC addressed the effects natural disasters are having on grain farmers and their ability to transport their grain in a statement to the Agricultural Advisory Committee this summer: “Shifting weather patterns and more extreme weather threaten crops and livestock via hurricane, wildfire, and drought. They are also making it more difficult to get these products to market. That’s why I’m very interested to hear about developments in Mississippi River barge traffic.”

So here we have high-impact events that involve the preservation of human life as well as hundreds of millions of dollars in recovery efforts and reconstruction. And sometimes damages exceed the millions, with the U. S Department of Agriculture announcing last year that “commodity and specialty crop producers impacted by natural disaster events in 2020 and 2021 will soon begin receiving emergency relief payments totaling approximately $6 billion through the Farm Service Agency’s (FSA) new Emergency Relief Program (ERP) to offset crop yield and value losses.”

Preparation Forecasting for Natural Disasters

Insurance costs, governmental resilience, human lives, all rest of the responsiveness of emergency aid. But the ability to actually predict when these events will occur and to what scale is varied and region-dependent. So where can forecasting provide added value? We think, preparation.

Because we cannot yet accurately predict when a natural disaster will occur, demand for commodities after such a disaster is often irregular, difficult to communicate, and changing. These inefficiencies can lead to an even larger loss of life, or exacerbated damages to infrastructure. And researchers have been working on this issue for some time.

In 2009, researchers from the School of Management, University of Science and Technology of China published a paper titled Forecasting demand of commodities after natural disasters. The authors used a combined approach of an autoregressive moving average model (ARMA) and an empirical mode decomposition model (EMD) to more accurately predict demand for commodities after a natural disaster.

And just last year, researchers from Taiwan published a report titled Multi-Commodity distribution under uncertainty in disaster response phase: Model, solution method, and an empirical study which suggests creating a “network flow model” where the resources of relief centers are connected by transportation webs that allow for a more efficient delivery of commodities during natural disasters.

While these areas of research might not address the issue at hand precisely, they do direct our attention into the right direction. Demand forecasting is critical to alleviate the damages created by less-predictable natural disasters. This summer the United States launched the Office of Pandemic Preparedness and Response Policy which coordinates the government's response to potential pandemics, advances pandemic preparedness, oversees scientific efforts, and provides periodic reports to Congress. Why not create an office like this for natural disasters? We have FEMA but…

Columbia University published research suggesting the prediction markets could be one potential salve to changing opinions on climate change and directing more focus towards climate-related issues, but if we’re using prediction markets to get people to care we might yet be too late :/

Future of Natural Disaster Forecasting

But let’s end on a bit of optimism.

Welthungerhilfe, a German private aid agency uses an approach to aid called Forecast-based Action which leverages “forecasting models that can predict natural disasters and their effects on the local population.” The organization implements Early Action Protocols to determine the level of funds to be released in the case of a particular natural disaster, where that money will be used, and how it will be distributed.

And the International Federation of Red Cross and Red Crescent Societies (IFRC) use an approach called Forecasting-Based Financing to anticipate natural disasters and take action before those disasters occur. They have a helpful YouTube video that explains their approach.

While first-order thinking would lead one to consider how to better forecast the occurrence of natural disasters, second-order thinking will lead you to forecasting their effects. And that is where we think more attention should be focused. Forecasting commodity demand after a natural disaster is not just about humanitarian aid, either. These events can significantly impact commodity markets, currency exchange rates, and geopolitics more broadly (think of how the Arab world responded to the Turkey-Syria 7.8 earthquake in February, especially Saudi Arabia).

We believe that in addition to using forecasting to predict events, we can use forecasting to anticipate demand (forecasts conditional on event outcomes) to increase responsiveness of aid during natural disasters and potentially other areas of emergency service as well. And we could add natural disasters as a top geopolitical risk in the coming years, and these acter-less events and the aid they require have just as much influence over the shape of geopolitical relationships. If you want us to write more about demand forecasting in the future, let us know!

And finally, one useful tool that you can use to take action in light of the recent tragedies in Morocco and Libya is Charity Navigator. Charity Navigator recently acquired Causeway, a charitable giving startup run by effective altruists, and is trying to increase the impact of, and participation in philanthropic/charitable giving.

Global Guess: Will Saudi Arabia and Israel Normalize Relations?

Back in 2021, during the third edition of our old series Metaculus Mondays, we forecasted whether Saudi Arabia and Israel would normalize relations.

In this week’s Patreon-exclusive live forecast we returned to the question in light of recent developments in the region, including Saudi-Iran rapprochement, increased Israeli-Palestinian tensions, Saudi Arabia’s invitation to BRICS, OPEC oil cuts in the context of the Russo-Ukrainian War & more.

OUR PREDICTION

There is a 1/6 chance Saudi Arabia and Israel normalize relations before 2025.

OUR FORECAST (PREFERENCES, CONSTRAINTS, AND SIGNALS)

Watch Clay and Andrew forecast Will Saudi Arabia and Israel Normalize Relations before 2025 on PATREON.

RECORD YOUR PREDICTIONS

What should we predict in our next Global Guess? Let us know!

The Base Rate: New PM, CFTC Views on PM Enforcement & more

BitMEX's Prediction Market Is Now Live | CoinDesk | 09.12.23

🥩 The meat: BitMEX, a large cryptocurrency derivatives exchange, entered the prediction market space this week.

🥔 The potatoes: Why doesn’t every crypto exchange introduce PMs? It encourages users to keep money on the platform to gamble with and it also can drive revenues. One reason might be because…

PLI White Collar Crime 2023 Keynote Speech of Enforcement Director Ian McGinley: “Enforcement by Enforcement: The CFTC’s Actions in the Derivatives Markets for Digital Assets” | CFTC | 09.11.23

🥩 In a speech this week, Ian McGinley of the CFTC laid out the organization’s stance on prediction markets, including cryptocurrency ones by invoking the 2021 investigation and 2022 settlement of Polymarket by the CFTC, putting it simply:

Polymarket thus stands for a fundamental principle: that all derivatives markets must operate within the law regardless of the technology or legal structure used.

🥔 While Kalshi might have been the first CFTC-approved prediction market, we expect such a qualification to become standard soon, particularly when considering the trends in the cryptocurrency regulatory environment.

When should NYC worry about Lee’s path? Making sense of hurricane forecasts | Gothamist | 09.11.23

🥩 Explaining hurricane forecasts and their development / updates under the context of Hurricane Lee.

🥔 Although now a mere “post-topical cyclone”, the article is a fascinating read on an important class of forecast.

Human and Algorithmic Predictions in Geopolitical Forecasting: Quantifying Uncertainty in Hard-to-Quantify Domains | Perspectives on Psychological Science | 08.29.23

🥩 New research paper from Barbara Mellers, John McCoy, and Philip Tetlock comparing human versus machine (algorithmic) forecasting in geopolitics. Like other research before it, humans perform best (and often better) than machines when dealing with conditions of poor data quantity and quality.

🥔 However, the best solution is hybrid forecasting—where algorithmic forecasting guides and influences human predictions. Not surprising, but perhaps more motivation for us to finally use Squiggle and take our forecasts to the next level.